Credit Cards That Are Good For Travel

What is the Snowball Method To Paying Off Debt - The

The debt snowball and debt avalanche methods are two of the best ways to get out of debt. Discover the pros and cons of each debt reduction method. Paying off debt is no easy task especially if you just pay the minimum amount due each month. To get free and clear you often have to accelerateThe debt snowball method is a debt-reduction strategy where you pay off debt in order of smallest to largest gaining momentum as you knock out each remaining balance. When the smallest debt is paid in full you roll the minimum payment you were making on that debt into the next-smallest debtThe debt-snowball method is a do it yourself debt-reduction strategy whereby one who owes on more than one account pays off the accounts starting with the smallest balances first while paying the minimum payment on larger debts.The debt snowball strategy helps you pay off your debts by tackling the smallest balances first and building momentum toward the larger ones. The snowball method isn t right for everyone though. In some cases it might not make sense to accelerate your payments on certain debts.With the debt snowball method of paying off debt you reward yourself for wins along your debt payoff journey. You pay your smallest debts in full You might wonder whether you can ever pay off your debt even with a debt snowball plan to keep you focused. If your unsecured consumer debtsWith the debt snowball method you pay down your debts in order from smallest to largest. Basically you allocate any extra income savings to paying down your smallest debt while making minimum payments on all other debts. Then once that debt is paid off you apply all the money you

The debt snowball method was originally made popular by personal finance expert Dave Ramsey. This debt-repayment method which Each balance payoff is a win. It s a debt-repayment method that may not save you money on interest but could be a great motivator to keep paying off your debt.What is the Dave Ramsey Snowball method and does it help pay off your debt faster -OTHER COMPANIES TO HELP SAVE MONEY Mint Mobile for cheap cellDebt Snowball vs Debt Avalanche. Now I already know what some of you are going to say. Some of you are convinced that the debt avalanche is the best way to pay down For those of you who are new to the term the debt avalanche method has debtors pay off their debts in order of interest rate.The method and strategy for the debt snowball method is very straightforward. It works like this you pay off your credit card or other loan with the lowest The key to the snowball method lies in the exponential payoff power but the trick is it requires the momentum of a card or two paid off to reallyFrom a financial perspective paying off your higher interest rate balance first is the most prudent course of action. If the avalanche and snowball method have you spinning and still paying high interest rates on multiple cards you can consolidate your credit card debt with a credit cardThe debt snowball approach to paying off debt is primarily used for paying down high interest credit card debt but it can be used to pay down any non-mortgage debt. With this approach you ll drop whatever monthly payments you re making down to the minimum amount due on all of your debts

The snowball method which has been popularized by The Total Money Makeover author Dave Ramsey prioritizes your smallest debts first regardless of interest rate. The snowball method worked for Derek Sall who paid off more than 100 000 in seven years and became debt-free by 30.How the debt snowball method works is actually quite simple. Start by ranking your debts in order by the amount you owe from smallest to largest. Next put all the money you ve budgeted for debt repayment toward the smallest of those debts and only pay the minimum payment on your otherThe idea behind the debt snowball method is to sort your debts from the smallest balance to largest balance says Matt Frankel certified financial planner You make minimum payments on all but your smallest balance. You pay as much as possible toward the smallest debt to pay it off in full as soonThe debt snowball method is a strategy that uses motivational momentum to reduce and eventually eliminate your debts. You pay off each debt starting with your smallest and work your way up to your largest. The quick wins from paying off smaller debts give you the motivation you need to keep goingAnother way to pay off debt is the avalanche method. This involves paying off as much as possible towards your debt balance with the highest interest while making minimum payments on your others. First create a budget to work out exactly how much money you can put towards paying off your debt.The debt snowball method is a financial strategy popularized by personal finance author and radio talk show host Dave Ramsey. It s targeted at people who Done correctly the debt snowball should help you pay off your debts much more quickly and with less interest than if you only made the minimum

Fans of the snowball method believe that paying off smaller balances can keep people motivated and on track as you get the regular satisfaction of knowing you have paid off a debt or closed an account. Also if you are being bombarded with debt letters and repayment calls clearing some of theThe debt snowball method directs you to pay your debts off by starting with the smallest one and working upward. Each time you pay a debt off you Proponents of the debt snowball method point out that its greatest advantage is the psychological boost it gives people. Since they pay off theirHe used the snowball method to pay off roughly 100 000 worth of debt including his mortgage . The strategy worked so well for Sall that he decided to share his spreadsheet for paying back debt on his blog Life And My Finances to help others take advantage of it. I suggest that people pay offWhat is the debt snowball method Simply put it s a debt elimination plan where you pay off your debts in order from lowest to highest balance Why do so many people use this payoff method Because it works The debt snowball method can light a fire under you and rocket you forward like The debt snowball is a great tool to help pay off debt faster because it motivates you to see progress when you re paying off debt says student loan debt expert Robert Farrington. How the debt snowball method works. Susie has three consumer credit cards and a large student loan.The Debt Snowball Method is a strategy for paying off debt that has you prioritize your debt payoff in order from lowest amount owed to highest. But when you use the debt snowball method you will be able to knock out your lowest debts first which frees up tons of money for paying off your larger

At-A-Glance The debt snowball method is a debt repayment strategy. It focuses on paying off your debts in order from smallest dollar amount to largest. to paying off your debt the debt snowball method might be right for you as long as you reThe debt snowball method works by first organizing your debts from smallest to largest amount. This includes your student debt car loan any credit card or medical debt and mortgage. Continue paying the minimum payment for all your debts and then put any and all extra cash towards paying off theWhat Is the Debt Snowball Method If you compare your debts to your assets and find that you owe more than you earn or own it s time to get to work paying Over time each debt that is paid off helps you gain momentum because you take the payment you would normally make on the old debt eachIf you decide to use the snowball method to pay down debt start by listing your debts from smallest to largest. The first entry could be a utility bill that is overdue a small amount you borrowed from your line of Sometimes paying off the smallest bill at minimum monthly payments is all we can afford.Roth calls this the debt snowball a method made popular by businessman and author Dave Ramsey. The blogger said he used the method to get out of 35 000 of consumer debt when he was in his mid-30s. It took 39 months just over 3 years to pay off the 35 000 once I started focusing onThe snowball method involves paying off your smallest debts first. For example say you have 3 credit cards with the following balances Think of it as snowballing your payments and they ll get larger and larger because the more debt you pay off the more money you ll have to put towards your

23 Chores for Kids to Earn Money

Pound euro exchange rate Sterling DIPS as Bank of England

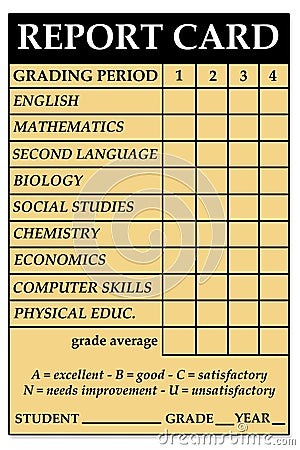

High School Report Card Stock Photography - Image 30376992

Very Good Job Stock Photography - Image 14787172

Twelve Cupcakes Boss Day Special 10 Off With Minimum

Hang Loose Royalty Free Stock Image - Image 15605776

Sexy Athletic Male Model In Blue Jeans Stock Images

Longevity Symbols Collection Royalty Free Stock Photos