Tax Deduction Travel Expenses

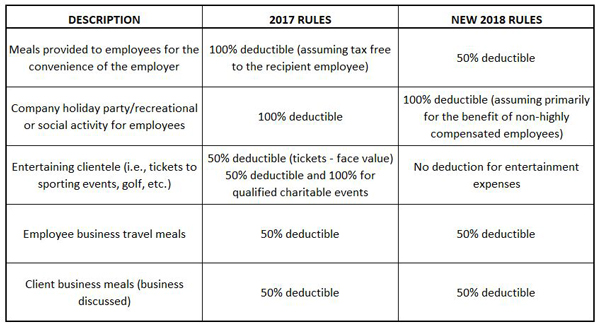

Reduced Tax Benefits for Meals Entertainment in 2018

The Tax Cuts and Jobs Act of 2017 imposes stricter limits on the deductibility of business meals and entertainment starting January 1 2018. Starting in 2018 employers will only be able to deduct 50 of what they spend to keep their team members tummies full.Meals Entertainment 2018. With the passage of the new tax law meal and entertainment expenses as we know it will be eliminated. Businesses will no longer be able to deduct entertainment expenses subject to the 50 limitation. Furthermore working meals for employees will be subject toThe recently passed tax reform law made massive changes to the deductions businesses can take for meals entertainment and other benefit-related Employers that offer paid family and medical leave programs that meet specified conditions are eligible for a temporary tax credit starting in 2018.Employee meals provided for convenience of employer ex. meals provided by employer for employees working overtime or meals provided at onsite cafeteria . Reimbursed meals and entertainment expenses ex. business charges its clients fees plus expenses and provides their clients with detail ofReduced Tax Benefits For Meals Entertainment In 2018 Kruggel. New jersey employers must offer employees pre tax muter benefits meals entertainment expenses key details some pcsing civilian workers get tax relief but others will need oregon department of revenue tax professional s liaisonIn effect the reduced tax benefits will mean these expenses are more costly to a business s bottom line. Note that for 2018 through 2025 employees can t deduct unreimbursed employee business The TCJA s changes to deductions for meals entertainment and transportation expenses may affectReduced Tax Benefits for Meals . Meals and Entertainment. Transportation. Assessing The Impact. Along with tax rate reductions and a new deduction for pass-through qualified business income the new tax law brings the reduction or elimination of taxBusiness Meal Deduction - After Tax Reform. The expense is an ordinary and necessary expense under Food and Beverages purchased during or at an entertainment activity must be purchased Employer s ability to fully deduct expenditures associated with de minimis fringe benefit meals asEmployee Benefit Plans. Manufacturing and Distribution. Physicians and Physician Practices. Click the link below for an update on the changes for Businesses in 2018 for Meals and Entertainment.

The general rule for deductions related to meals and entertainment expenses is that you can deduct up to 50 of the cost of meals and entertainment or anOther rules for meals and entertainment expenses. Inclusion Amounts for Passenger Automobiles First Leased in 2018. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2 590 000. A working condition fringe benefit is any property or service provided to you by your employer the cost of which would be allowable as anIn effect the reduced tax benefits will mean these expenses are more costly to a business bottom line. Note that for 2018 through 2025 employees can t deduct unreimbursed employee business The TCJA s changes to deductions for meals entertainment and transportation expenses may affectCommon entertainment scenarios. Tax-exempt body entertainment fringe benefits. Reducing your reportable fringe benefits amount. Calculating your FBT. The more elaborate a meal the more likely it is that entertainment arises from eating the meal.In particular there are frequent questions about how entertainment and client meal expenses are handled. Before TCJA companies for the most part With such sweeping changes coming in with that Tax Cuts and Jobs Act TCJA there has been a fair amount of confusion with how certain deductionsHow to set up a sales tax rate for Meals and Entertainment. An entertainment tax is a fee that some local or regional governments charge on any form of service Different areas of the world define entertainment in vastly different ways some tourist areas collect an entertainment tax from everyContinue reading for insights on accounting for meals and entertainment expenses for tax purposes and properly recording expenses throughout the year. In recent years several changes have been made to how businesses must account for their meals and entertainment expenses for tax purposes.And meals and entertainment for business purposes are a legitimate business tax deduction. However there are limits to what you can Some meals you give to employees are considered benefits so they are taxable to the employees and you must report these benefits on their W-2 form.Taxation. An aspect of fiscal policy. v. t. e. A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit.

In effect the reduced tax benefits will mean these expenses are more costly to a business s bottom line. Note that for 2018 through 2025 employees can t deduct unreimbursed employee business The TCJA s changes to deductions for meals entertainment and transportation expenses may affectThe Trump tax plan simplifies the tax structure but reduces revenue by 1.5 trillion. Business tax cuts are permanent. Individual cuts expire in 2026. The TCJA also cut the corporate tax rate from 35 to 21 effective in 2018. The corporate cuts are permanent. The individual changes expire at the end ofBeware New 2018 Tax Act Meal And Entertainment Deduction. Deduction Trees Of Resolution Examples. Employee Meals As Fringe Benefits Could Earn A Larger Irs. Meals And Entertainment What Can I Write Off. Are Meals And Entertainment Still Tax Deductible Under The.Scott MacKenzie . Casey Neistat Casey 19 . 2018 . For individuals and families the final Tax Cuts Jobs Act lowers individual taxes nearly doubles the standard deduction expands the Child Tax Credit repeals Obamacare s individual mandate preservesThe ProSource Produce LLC recall of whole raw onions red yellow and white shipped from Chihuahua Mexico between July 1 2021 and Aug. 31 2021 for Salmonella contamination is rippling through food chains. including those of home meal delivery services.The term tax benefit refers to a tax law that helps taxpayers reduce their tax liabilities. Tax benefits are often created as a type of incentive for promoting responsible behaviors or commercial activities. These benefits range from deductions to tax credits to exclusions and exemptions.Apart from the usual living expenses cap of 9010 and meal entertainment for holiday accomodations and meals cap of 2650 which I max out each I was wondering if there was anything else I could do to maximise my use of salary sacrificing to reduce my taxable income Note that I also don t want toYour contributions are made before tax reducing your current taxable income meaning you get a tax break the year you contribute. Fidelity does not provide legal or tax advice and the information provided is general in nature and should not be considered legal or tax advice.Major tax evasion and avoidance schemes have cost governments an estimated 150bn 127bn in lost revenues research shows. So-called cum-cum and cum-ex schemes are designed to exploit weaknesses in national tax laws. They apply to the payments or dividends firms make to shareholders.

That is likely to benefit DoorDash the U.S. industry leader with 50 market share and the next biggest players a combined Uber Eats and Postmates then Grubhub Many couriers who deliver food and other goods for these companies are independent contractors with low pay and little or no benefits.Gifting appreciated assets can significantly reduce your tax liability and enhance the flexibility of your investment portfolio making portfolio Let s look at another hypothetical example of a married couple filing jointly who are in the highest income tax bracket. In 2018 let s assume their itemized deductions

Dome Tax Deduction File Book - 9 3 4 x 11 Sheet Size

The Paper Trail Tax Deductions for Business Expenses

5 Tax Deduction Secrets You Should Know Before Your Next

Download Form 12BB PDF to Claim Employee s Tax Exemptions

Work Related Travel Expenses Online Tax Australia

New Limitation On Meals And Entertainment Deductions Could

The GOP s Tax Bill Is a War on Disabled People

How to Claim a Tax Deduction for Medical Expenses in 2020

Do You Know About These HSA Qualified Expenses